Chapter 13 Discharge Papers Can Be Fun For Anyone

Getting My How To Get Copy Of Bankruptcy Discharge Papers To Work

Table of Contents5 Simple Techniques For How To Get Copy Of Chapter 13 Discharge PapersGetting The How Do I Get A Copy Of Bankruptcy Discharge Papers To WorkSome Known Details About How To Obtain Bankruptcy Discharge Letter How Do You Get A Copy Of Your Bankruptcy Discharge Papers Can Be Fun For EveryoneIndicators on Obtaining Copy Of Bankruptcy Discharge Papers You Need To KnowThe smart Trick of Copy Of Bankruptcy Discharge That Nobody is Discussing

This shows creditors that you're major about making a change in your monetary scenario and raising your credit rating gradually. Reduced levels of financial obligation can likewise aid you receive a home mortgage. The fastest and easiest method to elevate your credit report is to make your credit history card and loan settlements on schedule every month - chapter 13 discharge papers.

Obtaining preapproved is essential for a couple factors: First, a preapproval letter allows you understand which homes remain in your spending plan and also allows you to tighten your building search. Second, a preapproval informs property agents and also vendors that you can secure the financing you require to get the residence you wish to make a deal on.

Getting My Bankruptcy Discharge Paperwork To Work

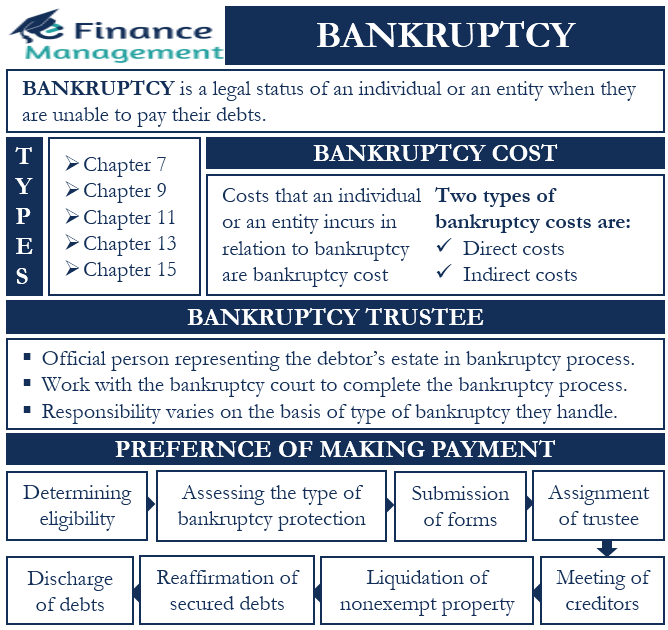

a legal case in which a person that can not pay his/her expenses can obtain a fresh economic begin. The right to declare personal bankruptcy is attended to by government legislation, as well as all insolvency cases are dealt with in federal court. Consequently, it is important to have a lawyer. An individual that files for bankruptcy is called a (https://www.jobsrail.com/author/b4nkruptcydc/).

Home which is not exempt is offered and the cash distributed to lenders. In a Chapter 13 situation, you submit a strategy demonstrating how you will repay a few of your past-due and also current debts over a prolonged duration, generally three to five years. After you complete the plan, the overdue balance on specific debts may be erased.

The quantities of the exceptions are when a wedded couple documents with each other - https://b4nkruptcydc.bandcamp.com/album/copy-of-bankruptcy-discharge-papers. A few of your creditors might have an in your home or personal property. This indicates that you gave the lender a home mortgage on your residence or place your property up as collateral for a financial obligation. If you do not make your settlements on the debt, the lender might be able to take and sell the home or property.

Some Known Facts About How To Obtain Bankruptcy Discharge Letter.

If you are behind in your payments, the court in a Phase 13 bankruptcy can offer you time to capture up. For some kinds of property, you can pay the creditor the amount that the residential or commercial property is worth instead than the complete financial obligation. If you put up your house products as collateral for a lending, you might have the ability to maintain them without making any even more payments on the financial debt.

Yes. The fact that you have actually filed an insolvency can appear on your credit history document for ten years. Because insolvency wipes out your old financial debts, you need to be in a far better placement to pay your current costs, so insolvency might in fact help you obtain credit scores. An utility, such as an electric business, can not refuse or reduce off service due to the fact that you have declared insolvency. https://yoomark.com/content/bankruptcy-discharge-order-court-releases-you-personal-liability-certain-debts-you.

Each instance is various. This pamphlet is suggested to offer you general info and also not to give you certain legal suggestions. Please use the details found in this pamphlet very carefully given that the law is continuously altering and also the details may not accurately reflect any modifications in the regulation that occurred following the production and also magazine of the sales brochure.

Obtaining Copy Of Bankruptcy Discharge Papers - Truths

When an individual documents for Phase 7 personal bankruptcy, their purpose is to have as several of their financial debts released as feasible. What is an insolvency discharge, and also just how does it function in Georgia? When a financial debt is released in a Chapter 7 case, a lender is forever disallowed from launching or continuing collection initiatives.

Financial debts likewise need to be unprotected, meaning there is absolutely nothing for the lender to take if the financial debt is discharged. Only financial debts that developed before a personal bankruptcy was submitted are dischargeable. If a borrower data for past due amounts on their electrical bill, just the quantity that was incurred prior to the insolvency filing can be discharged.

The 45-Second Trick For Chapter 13 Discharge Papers

The reality that you have actually filed a personal bankruptcy can appear on your credit history document for 10 years. Given that insolvency wipes out your old financial obligations, you ought to be in a far better placement to pay your present bills, so insolvency might really help you get credit history.

When an individual data for Chapter 7 personal bankruptcy, their objective is to have as much of their debts you can find out more discharged as possible (https://b4nkruptcydc.bandcamp.com/album/copy-of-bankruptcy-discharge-papers). However what is a personal bankruptcy discharge, and how does it operate in Georgia? When a financial debt is released in a Phase 7 case, a lender is permanently barred from starting or proceeding collection initiatives.

The How To Obtain Bankruptcy Discharge Letter PDFs

If a financial institution does start or proceed collection efforts on a debt that has actually been released in insolvency, they remain in violation of the U.S. Personal Bankruptcy Code and might deal with penalties as well as various other permissions. Examples of actions a financial institution can no more take after a financial debt has been discharged include the following: Corresponding Calling Taking lawsuit to gather on a debt It is crucial to keep in mind that not all financial debts are dischargeable in a Chapter 7 bankruptcy.

Financial obligations likewise need to be unsafe, implying there is nothing for the financial institution to take if the debt is discharged. Only financial obligations that developed prior to a personal bankruptcy was submitted are dischargeable. For instance, if a debtor documents for unpaid amounts on their electric costs, just the amount that was incurred prior to the insolvency filing can be released.